- Get link

- Other Apps

The idea of cash laundering is essential to be understood for those working within the financial sector. It's a course of by which soiled money is transformed into clean cash. The sources of the money in precise are legal and the money is invested in a way that makes it seem like clean money and hide the identification of the legal a part of the money earned.

Whereas executing the financial transactions and establishing relationship with the brand new customers or sustaining current prospects the duty of adopting sufficient measures lie on every one who is part of the organization. The identification of such factor at first is easy to cope with as a substitute realizing and encountering such conditions later on within the transaction stage. The central bank in any nation provides complete guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously present enough security to the banks to deter such situations.

Money laundering is the illegal process of making dirty money appear legitimate instead of ill-gotten. Money Laundering meaning in law Money laundering is a term used to describe a scheme in which criminals try to disguise the identity original ownership and destination of money that they have obtained through criminal conduct.

Anti Money Laundering Directive How Will It Affect Your Business Rocket Lawyer Uk

The USA Patriot Act was passed to fight money laundering.

What is money laundering entity. They must be prevented from financing money laundering and. The investments made by criminals may even give them a degree of influence over people businesses and legal sectors. Federal law defines money laundering as conductingor attempting to conducta financial transaction using proceeds that the person knew were the result of unlawful activity either as part of that illegal activity or knowing that the transaction would conceal or disguise the illegal activity or to avoid reporting the transaction to the government.

If the laundered money is worth 250000 or more then the fine would be double that. What is Money laundering. The Anti-Money Laundering Directive requires obliged entities eg financial institutions to carry out Customer Due Diligence CDD in order to prevent the holding of anonymous accounts as well as in circumstances that meet certain monetary thresholds or where there is suspicion that activity may be related to money laundering or terrorist financing.

Money laundering is the process by which the proceeds of crime or illicit activity are concealed by laundering or cleaning of the dirty money. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin and made to. The laundering is done with the intention of making it seem that the proceeds have come from a legitimate source.

Believe it or not but the US government only made concealing illegal cash a crime in 1986. Proceeds from illegal activity may include gambling crime fraud terrorist activity bribes or money obtained due to the influence of important positions. Money laundering is the process of disguising the proceeds of crime and integrating it into the legitimate financial system.

Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. The fight against money launderers also involves the collaboration between several domestic and international government organizations as this crime often takes place in various countries. Means a transaction carried out on behalf of a person the originator through a reporting entity by electronic means with a view to making an amount of money available to a beneficiary who may also be the originator at another reporting entity.

Before proceeds of crime are laundered it is problematic for criminals to use the illicit money because they cannot explain where it came from and it is easier to trace it back to the crime. Money laundering encourages criminal behaviour because it allows criminal money to be used in daily life. The activity of money laundering involves the intentional or reckless conversion of tainted property generated from criminal conduct into clean property so that the criminal origin of.

Money is laundered through any one or several of the following processes. Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. Anti Money Laundering AML also known as anti-money laundering is the execution of transactions to eventually convert illegally obtained money into legal money.

For example a felon that concealed 300000 would pay 600000 instead of 500000. Any person or entity connected with a financial transaction which can pose significant reputation or other risks to the bank say a wire transfer or issue of a high value demand draft as a single transaction. Money is the driving force for almost all forms of crime.

Criminals use a wide variety of money laundering techniques to make illegally obtained. AML legislation is becoming increasingly strict for financial service providers. The Anti-Money Laundering Act is a collection of several acts and policies that work together to prevent and prosecute money-laundering crimes in the US.

Why Preventing Money Laundering Needs To Be A Top Priority For Companies Eqs Group

Money Laundering Why It S Bad For Society Business And The Economy

Art Market In The Frame Of Money Laundering

Detecting Money Laundering More Quickly With Entity Resolution

Can Technology Help Fix The Dutch Money Laundering Crisis Arachnys

Aml Screening How It Might Infiltrate Your Business

Anti Money Laundering Use Cases For Graph Analytics Linkurious

Shell Companies And Money Laundering How To Combat Them

The Fifth Money Laundering Directive 5amld Explained In Detail By Yury Myshinskiy Medium

What To Know About Anti Money Laundering As A P2p Investor Viainvest Blog

An Introduction To Aml Part 2 Methods Of Money Laundering Planet Compliance

Money Laundering Overview How It Works Example

Pdf Modelling Of Money Laundering And Terrorism Financing Typologies

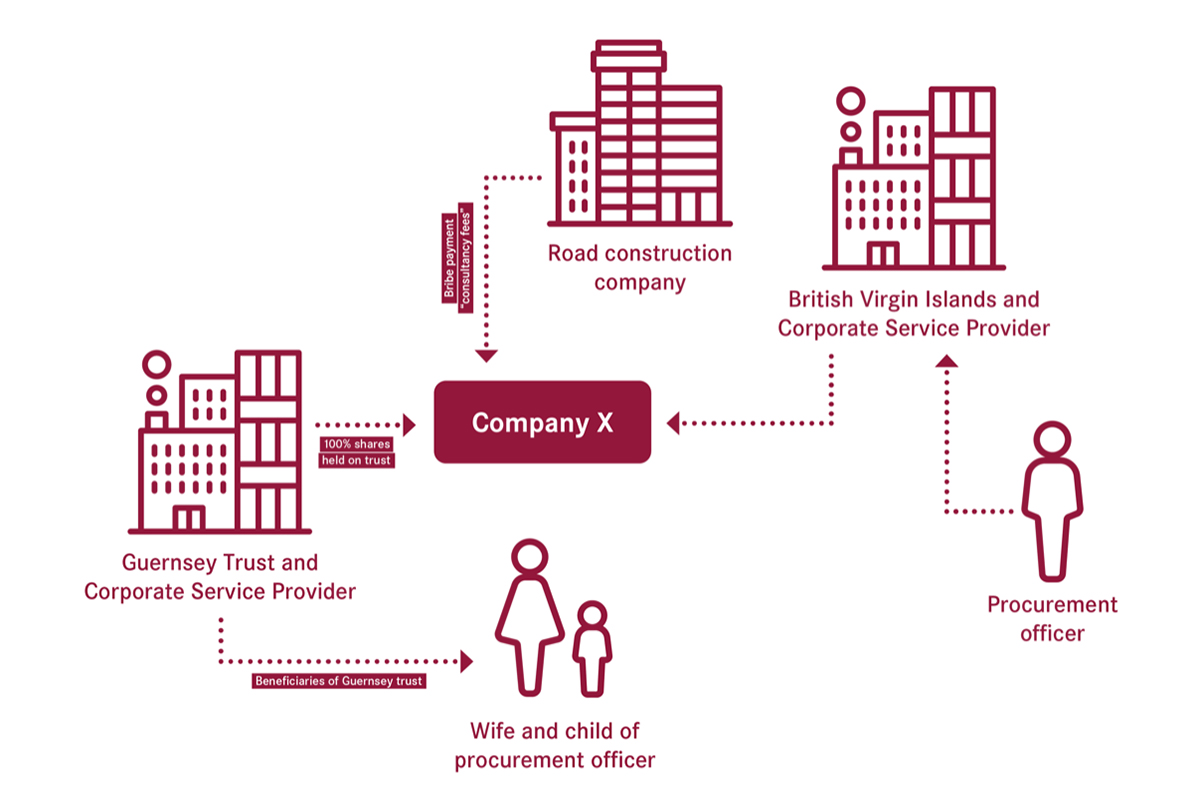

Phyllis Atkinson S Quick Guide To Offshore Structures And Beneficial Ownership Basel Institute On Governance

The world of rules can seem like a bowl of alphabet soup at times. US money laundering regulations are not any exception. We now have compiled a list of the top ten money laundering acronyms and their definitions. TMP Threat is consulting firm focused on defending financial companies by lowering risk, fraud and losses. We now have big financial institution experience in operational and regulatory risk. We have a robust background in program administration, regulatory and operational risk as well as Lean Six Sigma and Business Course of Outsourcing.

Thus money laundering brings many hostile penalties to the organization because of the dangers it presents. It will increase the probability of main dangers and the chance price of the bank and in the end causes the financial institution to face losses.

Comments

Post a Comment