- Get link

- Other Apps

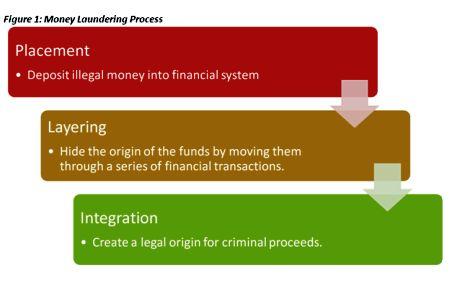

The idea of cash laundering is essential to be understood for these working in the financial sector. It's a process by which dirty cash is converted into clear cash. The sources of the cash in precise are prison and the money is invested in a way that makes it appear to be clean money and hide the identity of the felony part of the cash earned.

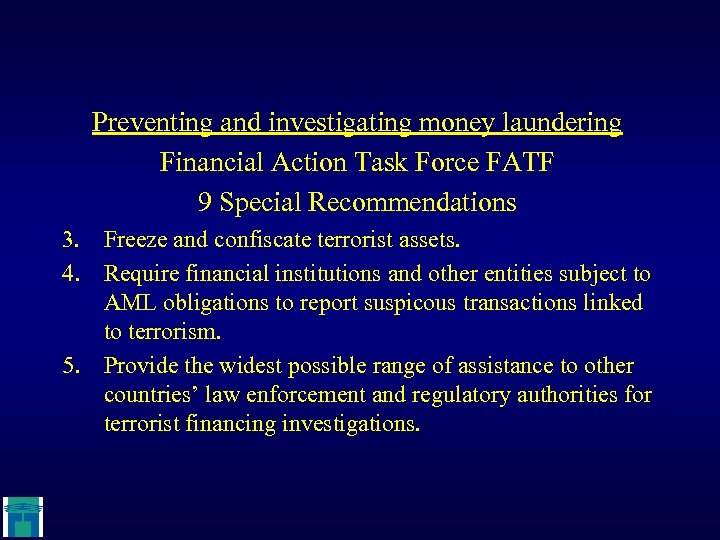

Whereas executing the financial transactions and establishing relationship with the brand new clients or maintaining existing prospects the responsibility of adopting enough measures lie on every one who is a part of the organization. The identification of such ingredient in the beginning is straightforward to cope with as a substitute realizing and encountering such conditions later on within the transaction stage. The central bank in any nation gives complete guides to AML and CFT to fight such activities. These polices when adopted and exercised by banks religiously provide sufficient security to the banks to deter such conditions.

Crimes that generate significant financial proceeds such as theft extortion drug trafficking and human trafficking almost always require a money laundering component so that criminals can avoid detection by authorities and use the illegal money that. Along with some other aspects of underground economic activity rough estimates have been put forward to give some sense of the scale of the problem.

Prevention Of Money Laundering Combating Terrorist Financing Ppt Video Online Download

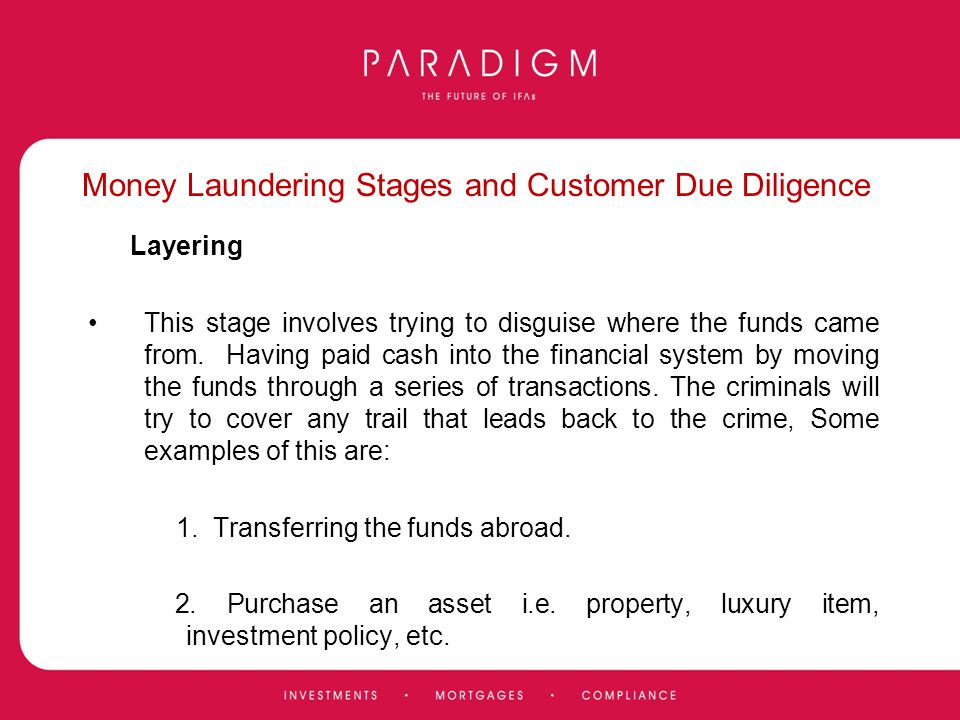

Once the funds have been placed into the financial system the criminals make it difficult for authorities to detect laundering activity.

Layering financial crime. The process of making illegally-gained proceeds ie dirty money appear legal ie clean typically involving three steps. Is when a financial institution such as banks is owned or controlled by unscrupulous individuals suspected of conniving with drug dealers and other organised crime groups. The criminals may even hire money mules to purchase.

The primary purpose of this stage is to separate the illicit money from its source. After the funds enter the financial system the money is layered or shifted through a series of transactions designed to create confusion and complicate the. Investments can be made into advanced financial options and moved frequently in order to successfully evade and avoid AML detection.

Money laundering regards the financial transactions in which individuals participating in criminal activity try to disguise the proceeds or sources from these transactions. This makes the process easy for launderers. Here the illicit money is separated from its source.

By layering financial transactions they try to obscure any trail that the authorities could follow to find the origin of the money. They do this by moving funds around multiple accounts splitting them into smaller amounts as they go and. During the layering stage the goal is to disconnect the money from the illegal activity that generated it.

Placement layering and integration. The complete liberalisation of the financial sector. There is an often quoted but incorrect statement that money laundering is the third largest global industry behind foreign exchange and oil and gas.

For example a person may attempt to hide drug dealing money by investing in a business. The Layering Stage Camouflage. Criminals may for example use their illegal funds to purchase large numbers of prepaid cards and then introduce their stored value into the legitimate financial system or transport the cards overseas to avoid the scrutiny of authorities.

This is a complex web of transactions to move money into the financial system usually via offshore techniques. Can we quantify the scale of money laundering. By its very nature money laundering is an illegal activity carried out by criminals which occurs outside of the normal range of economic and financial statistics.

Generally the more layers money passes through the harder it becomes to connect the funds to criminal activity. Prepaid cards can be used at the placement layering and integration stages of money laundering. Bangladeshs Anti-Corruption Commission ACC has charged 51 people including the Managing Director and President of a tree planting co-operative in connection with laundering BDT4000cr a staggering USD515m in funds embezzled from a tree planting scheme.

The second stage in the money laundering process is referred to as layering. This is done by the sophisticated layering of financial transactions that obscure the audit trail and sever the link with the original crime. According to the Financial Action Task Force money laundering can be summarised by the well known three stages.

The story in the Daily Star alleges links to a number of illegal activities which would. This is done by the sophisticated layering of financial transactions that obscure the audit trail and sever the link with the original crime. Layering is the process by which complex movements of funds allow them to no longer be traceable back to their original source.

Placement layering and integration. The Layering Stage is when criminals want to cut ties that could link the crime with the money. The US Treasury Departments Financial Crimes Enforcement Network FinCEN adheres to the model describing money laundering as.

This stage is the most complex and often entails the international movement of the funds. The criminal moves laundered money back into the financial system. The layering stage is the most complex and often entails the international movement of the funds.

Covid 19 Pandemic Turning Into A Financial Crime Threat

Documents Financial Action Task Force Fatf

Cyber Laundering The Money Laundering In The Digital Age Integrity Asia

Pdf International Anti Money Laundering Programs

What Is Money Laundering And How Is It Done

Cyber Laundering The Money Laundering In The Digital Age Integrity Asia

How Money Is Laundered In India Rediff Com Business

Aml Software Protect Your Business From Financial Crime Finacus Journal

Pdf Anti Money Laundering And Online Gambling Guidance On How To Implement Broad And Indistinct Aml Notions In Regulatory Practice Semantic Scholar

Basics Of Anti Money Laundering A Really Quick Primer Money Laundering Money Advice Business Advice

Prevention Of Money Laundering Seminar On Financial Services

Covid 19 Pandemic Turning Into A Financial Crime Threat

Money Laundering Terrorist Financing Are You Aware Anti Money Laundering Compliance Unit

The world of laws can seem to be a bowl of alphabet soup at times. US cash laundering rules aren't any exception. We now have compiled a listing of the highest ten money laundering acronyms and their definitions. TMP Threat is consulting firm focused on defending monetary services by reducing threat, fraud and losses. We've huge financial institution experience in operational and regulatory threat. We've got a strong background in program management, regulatory and operational risk as well as Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many antagonistic consequences to the group as a result of risks it presents. It increases the probability of main risks and the opportunity value of the financial institution and in the end causes the bank to face losses.

Comments

Post a Comment