- Get link

- Other Apps

The concept of cash laundering is very important to be understood for these working in the financial sector. It is a course of by which soiled cash is transformed into clear cash. The sources of the cash in precise are prison and the money is invested in a approach that makes it seem like clean cash and hide the identification of the criminal part of the money earned.

Whereas executing the financial transactions and establishing relationship with the new customers or maintaining existing customers the responsibility of adopting adequate measures lie on every one who is part of the organization. The identification of such element at first is easy to deal with as an alternative realizing and encountering such conditions in a while in the transaction stage. The central bank in any nation provides full guides to AML and CFT to fight such actions. These polices when adopted and exercised by banks religiously provide sufficient safety to the banks to deter such conditions.

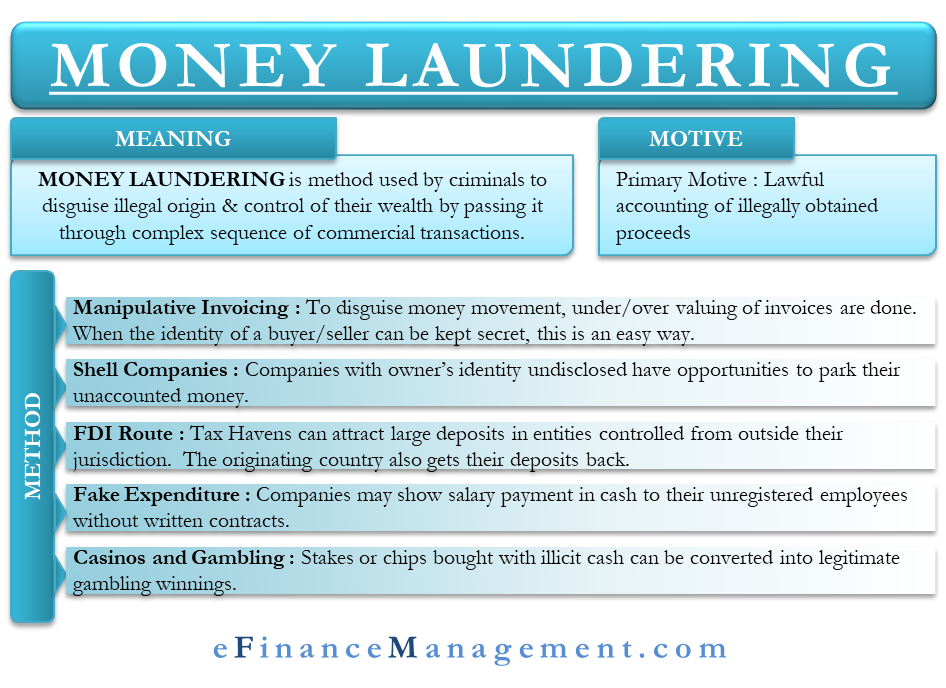

Money Laundering is an act of act of disguising the illegal source of income. The cash inflows and outflows are easy for launderers.

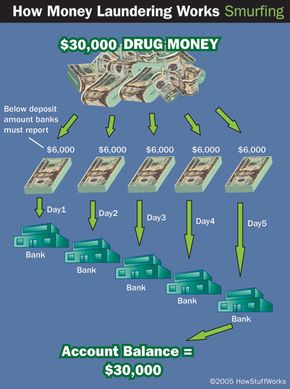

How Money Laundering Works Howstuffworks

Money laundering is a term used to describe the process of taking funds generated from illegal activities and making legitimate and clean.

How easy is money laundering. Finally theres the most serious type of money laundering in Arizona. Since money laundering is an illegal activity therefore one can only estimate the amount of money laundered every year. This means that the individual has played the most active role in the money laundering scheme.

In first-degree laundering an individual is accused of knowingly initiating organizing directing or managing a scheme designed to launder money. Conceptually money laundering is pretty easy to understand. If a criminal buys and sells things many times it is hard for the police to find out where the criminal got the money.

Money laundering is a threat to the good functioning of a financial system. But Office Space creator Mike Judges farcical setup does underscore an important point. The use of the Internet allows money launderers to easily avoid detection.

Basically different money launderers gain money from illegal sources and try to convert it into legitimate by using different ways. Combined with the consistent failure of regulators to fulfil checks on possible money laundering rings money laundering both within the UK and the wider world is simply getting easier. With the financial reward for such activities continuing to grow exponentially and little chance of being caught I can only anticipate that money laundering will become more extensive in the years to come.

Money passes through all these stages with intent to hide the original source and wrap it up with fake substitutes that prove it to legitimate money belonging to a legal person. By passing money through complex transfers and transactions or through a series of businesses the money is cleaned of its illegitimate origin. Its very easy to define but involves multiple techniques.

Placement layering and. Money laundering is the act of placing illegal gains into the legitimate financial system in ways that avoid drawing the attention of banks financial institutions or law enforcement agencies writes McCoy in USA Today. Money laundering involves three stages that contribute to the hiding of the original owner of illicit funds.

The report shows that in 2009 the criminal proceeds amounted to 36 of global GDP with 27 or USD 16 trillion being laundered. In this article we are going to explore three general stages of money laundering and ways to combat money laundering crimes. As a Class 2 felony first-time offenders will face 125 years in prison.

How much money is laundered every year. Banks around the globe spend around 8 billion on AML. The International Monetary Fund for example had stated in 1996 that the aggregate size of money laundering in the world could be somewhere between 2- 5 of the worlds gross domestic product This is 800 billion - 2 trillion in.

Money laundering is a crucial step in the success of drug trafficking and terrorist activities not to mention white collar crime and there are countless organizations trying to get a handle on the problemIn the United States the Department of Justice the State Department the Federal Bureau of Investigation the Internal Revenue Service and the Drug Enforcement Agency all have divisions. In economies where there are no regulations on laundering where there is a system that stores bank or customer information where banking secrecy is strictly enforced the informal economy ratio to the national economy is high. One way criminals launder money is by using the money earned from illegal activities to buy things like gold and silver shares or casino chips other legitimate business activities like food or liquor stores and then selling those items to get the money back.

Building a Defense Against Money Laundering. Due to the clandestine nature of money-laundering it is not easy to estimate the total amount of money that goes through the global economic system. Money laundering typically includes three stages.

In law enforcement investigations into organised criminal activity it is often the connections made through financial transaction records that allow hidden assets to be located and that establish the identity of the criminals and the criminal organisation responsible. However it can also be the Achilles heel of criminal activity. Money Laundering in the First Degree.

Money laundering is a process that criminals use in an attempt to hide the illegal source of their income. How does money laundering work. The rise of online banking institutions anonymous online payment.

Stages Of Money Laundering Https Tinyurl Com Tdxavfc Socialbookmarking Seo Backlinks Onlinemarketing Influen Money Laundering Social Bookmarking Money

Beginner S Guide To Money Laundering

Aml Introduction Stages Of Money Laundering Learn With Flip Youtube

Money Laundering Overview How It Works Example

Money Laundering Define Motive Methods Danger Magnitude Control

Become A Certified Anti Money Laundering Specialist Today Risk Management Risk Advisory University Of Ghana

Anti Money Laundering Overview Process And History

Money Laundering Ring Around The White Collar

How Money Laundering Works Howstuffworks

Aml Screening How It Might Infiltrate Your Business

What Is Money Laundering And How Is It Done

How Money Laundering Works Howstuffworks

5 Methods That Modern Money Launderers Use To Beat Detection Tookitaki Tookitaki

The world of rules can seem to be a bowl of alphabet soup at instances. US cash laundering rules are no exception. We now have compiled a listing of the top ten cash laundering acronyms and their definitions. TMP Danger is consulting firm centered on defending financial companies by lowering risk, fraud and losses. We have now big financial institution experience in operational and regulatory risk. Now we have a strong background in program management, regulatory and operational danger in addition to Lean Six Sigma and Business Process Outsourcing.

Thus money laundering brings many hostile consequences to the group due to the dangers it presents. It increases the chance of major risks and the opportunity cost of the financial institution and ultimately causes the financial institution to face losses.

Comments

Post a Comment