- Get link

- Other Apps

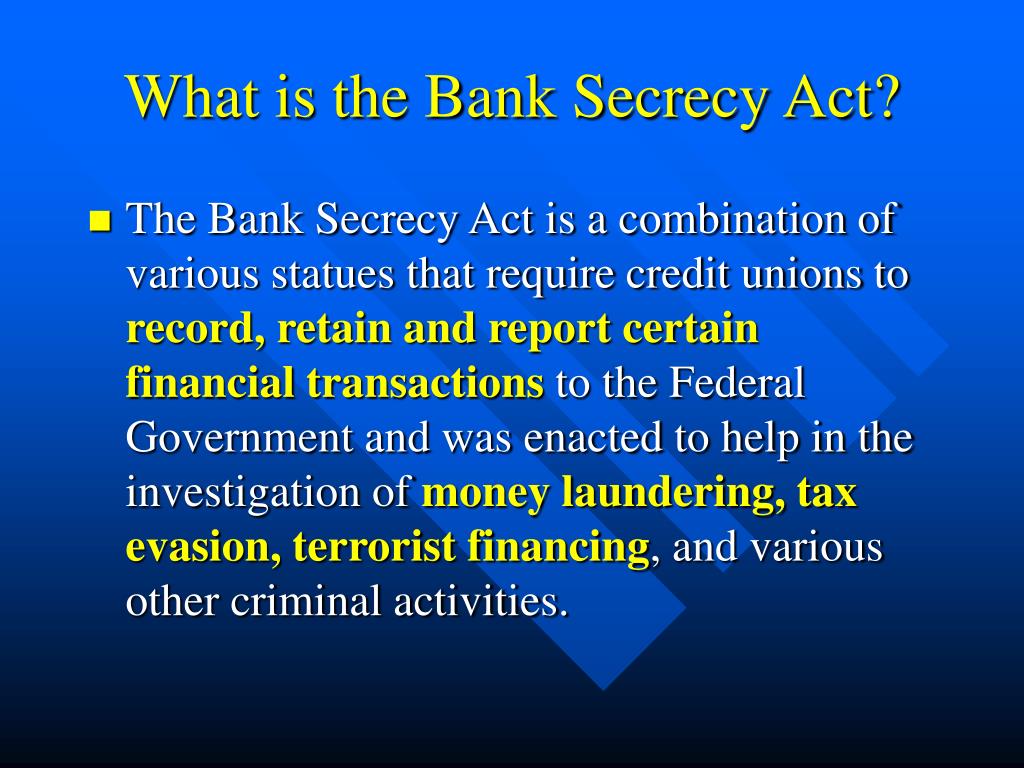

The concept of cash laundering is essential to be understood for those working within the financial sector. It's a process by which dirty money is transformed into clear cash. The sources of the cash in precise are felony and the money is invested in a means that makes it seem like clean money and conceal the id of the legal a part of the money earned.

Whereas executing the monetary transactions and establishing relationship with the brand new customers or sustaining present customers the duty of adopting satisfactory measures lie on each one who is a part of the group. The identification of such factor in the beginning is simple to cope with as an alternative realizing and encountering such situations in a while within the transaction stage. The central bank in any nation gives complete guides to AML and CFT to combat such activities. These polices when adopted and exercised by banks religiously present sufficient security to the banks to discourage such conditions.

This interactive course provides an overview of ACH wire and remittance transfers including processing requirements and required disclosures. 15 1990 hereinafter 1990 Funds Transfer Proposal.

Deterring Financial Crime With The Bank Secrecy Act Watchblog Official Blog Of The U S Government Accountability Office

Money transfers of 3000 or more to the same customer in a day regardless of the method of payment it must keep a record.

Bank secrecy act requirements for wire transfers. For transmittals of funds of 3000 or more brokerdealers are required to obtain and keep certain specified information concerning the transmittor and the. 1 the type of financial institution 2 its role in the wire transfer originator intermediary or beneficiary 3 the amount of the wire transfer and 4 the. Bank Secrecy Act Manual Supplement 1September 1997 The following is a summary of the revisions andor additions that have been made to the Federal Reserves Bank Secrecy Act Exam-ination Manual since its initial distribution in January 1995.

Under the Bank Secrecy Act financial institutions must maintain appropriate records and file reports involving certain currency transactions. The BSA does not require a bank to maintain records for the following types of funds transfers. 1 funds transfers where both the originator and beneficiary are the same person and that originators bank and the beneficiarys bank are the same bank.

FINCEN enforces the Bank Secrecy Act which requires banks and money service businesses to retain and report information about international wire payments. The information to be collected and retained depends upon. Detailed discussion of requirements of both domestic and international wires including.

Proposed Amendment to the Bank Secrecy Act Regulations Relating to Recordkeeping for Funds Transfers by Banks and Transmittals of Funds by Other Financial Institutions 55 Fed. IRM 4269 Examination Techniques for Bank Secrecy Act Industries has a subsection for each industry entitled Money Laundering Trends which includes examples of structured transactions. You may replace the entire con-tents according to Tabs.

Particular attention should be paid to wire transfers and other transactions to or from so-called offshore banks offshore bank accounts or offshore entities that are located in areas known for their lax banking and financial policies. Bank Secrecy Act requirements for wires and recordkeeping. Wire Transfer Reporting Requirements.

However the requirements of the Bank Secrecy Act apply only to activities of financial institutions within the United States. Bank Secrecy Act of 1970 also known as Bank Records and Foreign Transaction Act Money Laundering Control Act of 1986 Annunzio-Wylie Anti-Money Laundering Act 1992 USA PATRIOT Act. Part 3268b1 of the FDIC Rules and Regulations.

Thus for example part but not all of an international transmittal of funds can be subject to the Travel rule. Thus for example part but not all of an international transmittal of funds can be subject to the Travel rule. However the requirements of the Bank Secrecy Act apply only to activities of financial institutions within the United States.

The Department of the Treasurys Treasury amendments to the Bank Secrecy Act BSA which facilitate tracing funds through the funds transmittal process became effective May 28 1996. The Act prescribes regulations that mandate the reporting of specific activities including using wire transfers to send and receive money. Part 3268b1 requires each bank to develop and provide for the continued administration of a program reasonably designed to assure and monitor compliance with recordkeeping and reporting requirements of the Bank Secrecy Act or 31 CFR 103.

The examiner should review the appropriate subsections of IRM 4269 as part of the pre-planning process. Is this rule limited to wire transfers. The Bank Secrecy Act The Bank Secrecy Act BSA was enacted by Congress in.

In addition learners will recognize how to identify suspicious wire transfer activity and handle remittance transfer errors. How transactions may be structured is dependent upon the specific financial services offered. Maintainance of data on international wire transfers.

41696 1990 proposed Oct. 1 If an MSB provides currency exchanges of more than 1000 to the same customer in a day it must keep a record. Identification and authentication requirements.

FINCEN doesnt actually put a limit on the amount individuals or businesses can send overseas. And 2 transfers where the originator and beneficiary are any of the following. What Reg S Reg E Reg J Subpart B and UCC-4A have to say about wire transfers.

TAB 100WORKPROGRAM Anti-Money Laundering Procedures. 10333e and g for all wire funds transfers in the amount of 3000 or more.

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Bank Name Logo Employee Compliance Orientation Revised

Bank Secrecy Act Bsa Bsa Aml Cip Ofac For Loan Officers

Deterring Financial Crime With The Bank Secrecy Act Watchblog Official Blog Of The U S Government Accountability Office

Bank Secrecy Act Anti Money Laundering Program Ppt Video Online Download

Bank Secrecy Act And Anti Money Laundering Service Lexisnexis Store

Ppt Bank Secrecy Act Bsa Powerpoint Presentation Free Download Id 192736

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035

What Are The Anti Money Laundering Laws Nacho Money

Bank Secrecy Act Compliance Ppt Download

Bank Secrecy Act 101 Six Things Every Aml Person Needs To Know Acams Today

Ppt Bank Secrecy Act Powerpoint Presentation Free Download Id 522035

Bank Secrecy Anti Money Laundering Ofac Ppt Video Online Download

Bankers Compliance Training The Bank Secrecy Act Bsa

The world of rules can appear to be a bowl of alphabet soup at occasions. US money laundering rules are no exception. Now we have compiled an inventory of the highest ten cash laundering acronyms and their definitions. TMP Danger is consulting agency focused on protecting monetary providers by lowering threat, fraud and losses. We've got huge financial institution experience in operational and regulatory risk. We have a strong background in program administration, regulatory and operational danger in addition to Lean Six Sigma and Enterprise Process Outsourcing.

Thus cash laundering brings many hostile penalties to the organization as a result of risks it presents. It increases the probability of main risks and the opportunity value of the bank and in the end causes the financial institution to face losses.

Comments

Post a Comment